Is It a Good Neighborhood? How Can You Tell? What to Consider Before ‘Buying the Neighborhood’

Some people advocate for “buying the worst house on the best street.” Let’s look at how buyer agents evaluate a neighborhood.

Some people advocate for “buying the worst house on the best street.” Let’s look at how buyer agents evaluate a neighborhood.

You don’t just buy the home or the land, you also buy the laws governing it. Here are some surprises we can help home buyers avoid.

How many beds and baths? Those are key features of any home, but there are many more things to consider when buying a house in the Boulder area.

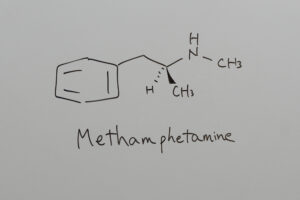

Meth contamination is a health hazard and expensive to remediate. We urge our home buyer clients to screen for meth once under contract.

After the Marshall Fire burned more than 1,000 homes in Boulder County in 2021, many households whose homes didn’t burn still had to clean.

April 2020 Many of you are wondering what’s going to happen to the real estate market given the coronavirus pandemic and its impact on the economy. We’re just a few weeks into this, but the data below may provide some initial insight. Effects on Showings First, as public concern with the virus and social distancing began to increase, the number of home showings in Colorado, and nationally, dropped dramatically, beginning March 11th and running through March 31st. Nationally, this leveled out at about 50% of normal by March 31st, but in Colorado there was a second steep drop beginning April 6th, with

Fireplaces are highly sought after in Colorado. Buyers dream of getting cozy and nestling up fireside next to loved ones.

Using Salvaged Items to Create Architectural Details in Your Home by Shannon Weissleder Old Doors are a Surefire Way to Add Character I have remodeled and flipped dozens of homes over the last decade. The easiest and most surefire way to add character to new homes or even older homes that lack charm is to incorporate found and salvaged items. New spaces need a bit of patina to create that desired character effect. Many of these items are meant to be architectural but they don’t necessarily have to be to give the illusion of architectural interest and detail. This photo

Preparing Your Home for Winter As the fall equinox comes and the weather begins to change, there are lots of things you can do around your home to get it ready for winter. First of all, this is the perfect time to give your home a once over. Furthermore, you want to make sure that everything is working like it should be before the snow flies. The following maintenance tips will make your house better and could help you save some money. Finally, you’ll ready to put up your holiday decorations! Fall Maintenance Tips Below, we have highlighted some of

Give That Dated Bathroom a Facelift By Shannon Weissleder Don’t let dated bathrooms scare you. Give that dated bathroom a facelift! They are fairly easy and inexpensive to update. We easily transformed this “pink lady” into a modern bathroom with tons of style. Update Your Flooring First, we simply updated the flooring with sheet vinyl that resembles vintage hexagon tiles in a neutral tone. We installed the flooring in about an hour for only about $150. Change Out Your Fixtures Then, we replaced the pink vessel sink with a small floating vanity ordered online, which gives the illusion of more