In spring of 2020, as the COVID-19 pandemic swept the globe, many potential home buyers were concerned about the wisdom of buying a house with a possible pandemic-induced recession looming. However, there’s pretty reliable data from the Great Recession of 2006-2007 suggesting that the risks of buying a home in Boulder County are relatively low. Mark Twain is reputed to have said that “history doesn’t repeat itself, but it rhymes.” The local impact of any COVID-19 recession is likely to “rhyme” with that of the real estate downturn of 2006-2011. This is due to the underlying fundamentals linking recessions, unemployment, foreclosures and falling house prices haven’t really changed. Let’s take a look at how history has affected Boulder home prices during recessions by looking at data from the Great Recession.

Effects of the Great Recession of 2006-2007

The first lesson from the Great Recession is that the impact of a recession, even a global one, is highly localized. If you take a city by city look at data from the Case-Shiller Home Price Index, it’s clear that every city in the US was impacted by the Great Recession. Even the general timing of price drops and subsequent recovery was similar from one city to another. That said, this data shows that the impact of the recession differed dramatically from one US city to the next. The average price depreciation from 2007 to 2011 was about 25% for the nation. A few cities like Portland and Seattle closely mirrored that national pattern. But cities like Miami, Los Angeles, and Washington, DC suffered much larger house price drops, in the 40-50% range. While cities like Phoenix and Las Vegas did much worse. Simultaneously, cities like Denver, Dallas and Charlotte suffered less, with price drops in the 10-15% range. That is roughly 1% and 2% annually over the course of the 2006-2011 decline in real estate values.

Did the Great Recession Affect Boulder Home Prices?

Turning to the Boulder County and nearby Front Range communities where Agents for Home Buyers works, we will take a more granular look at the data. There are further lessons about the localized nature of the recession’s impact on housing prices. In particular, the data show very tight relationships between the average educational levels in a community, levels of unemployment, and housing prices.

As reported by the Economic Policy Institute, unemployment rates by the end of the real estate downturn in 2011 were about 18% for adults without a high school diploma, 11% for those with a diploma, 5% for those with a bachelor’s degree, and 3% for those with an advanced or professional degree. In effect, while the recession was a crushing blow for many of those with a high school education or less, most of those with college degrees experienced the recession primarily as in the form of news stories and negative impacts on their retirement and investment portfolios.

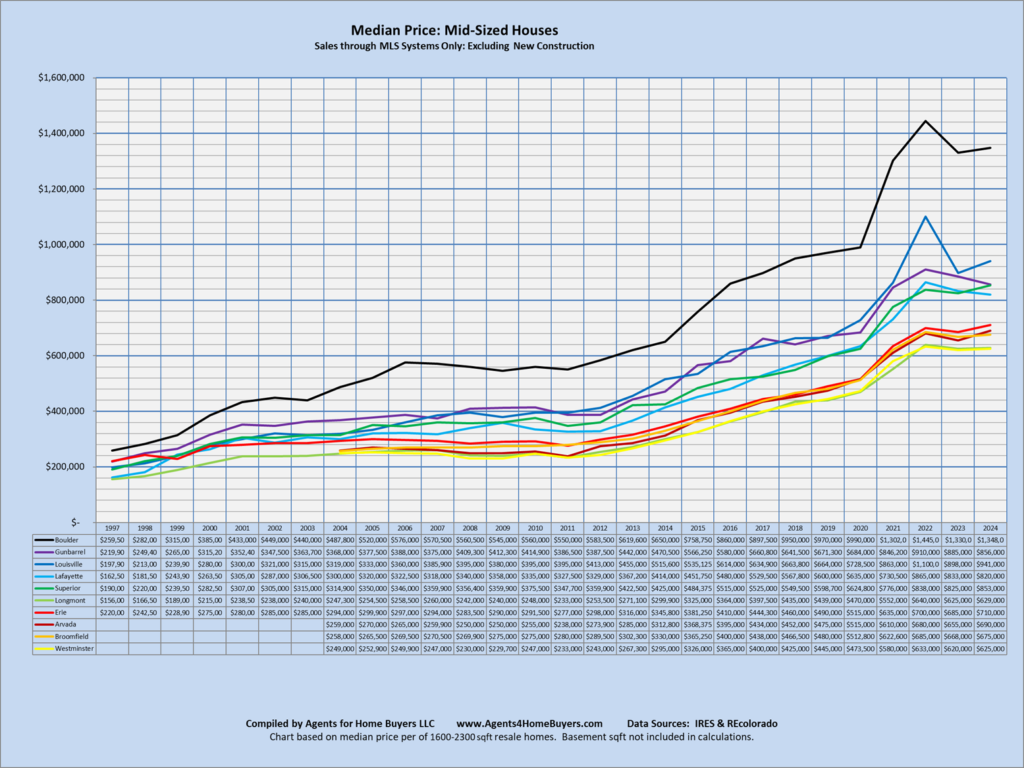

The summary chart below ties some of this together for our local communities. In cities like Boulder, Superior and Louisville, where more than 80% of residents have college or advanced degrees, only about 2% of all the real estate sales between 2007 and 2011 were bank sales due to foreclosures. Consistent with this, while house prices flattened out, they didn’t drop as they did in less fortunate cities in the area. The contrast is dramatic with cities like Northglenn or Commerce City, where only 20-23% of adults have college or advanced degrees, and the kinds of stable jobs likely to carry them safely through a recession. In those communities, nearly half of all home sales between 2007 and 2011 were bank sales, and this led to drops in housing prices averaging about 18% by 2011.

Comparing City, Education, Foreclosure and Price Drops, 2007-2011

| Cities | College Educated | Bank Sales | Price Change |

| Boulder Superior Louisville | 81%-87% | 2% | 0% |

| Erie Lafayette Broomfield | 57%-66% | 12% | -1% |

| Longmont Arvada Westminster | 39%-42% | 25% | -8% |

| Brighton Thornton | 28%-29% | 37% | -11% |

| CommerceCity Northglenn | 20%-23% | 46% | -18% |

Again, the housing markets in all of these cites were impacted by the Great Recession, but the impact varied dramatically. If you drill down deeper by looking at the detailed data on our website, you’ll see that this impact varied not only by community but by housing type. In Boulder, for example, the ratio of large, expensive homes selling during the recession dropped off significantly compared to sales of more affordable homes. In many cases, with a stock market that had dropped by 50%, it just didn’t make sense to pull $1,00,000 out of the stock market when those stocks had been worth $2,000,000 a year or two earlier. Meanwhile, in Boulder and Louisville, smaller and medium sized homes did well, actually appreciating a bit during the recession. And in every community we cover, condo and town-home prices were hit harder than prices for detached houses.

What Does It Mean for 2020?

The central message is that home prices in most of the communities we cover weren’t impacted dramatically by the Great Recession, for structural reasons related to education levels and job stability that remain unchanged today. The hardest hit communities where we work regularly, Longmont, Arvada and Westminster, did experience price drops of about 1% per year during the recession, but those prices recovered quickly beginning in 2012.

This isn’t a market for people who aren’t planning on being in a home for at least 3-5 years. With marketing and sales expenses, you can lose money on a house sale even in a fairly flat market over a short a time frame. But with that caveat, our local real estate market seems to be as safe a place to put your money as you’re likely to find with a potential recession on the horizon.