Market Update for March 2021

Housing Prices

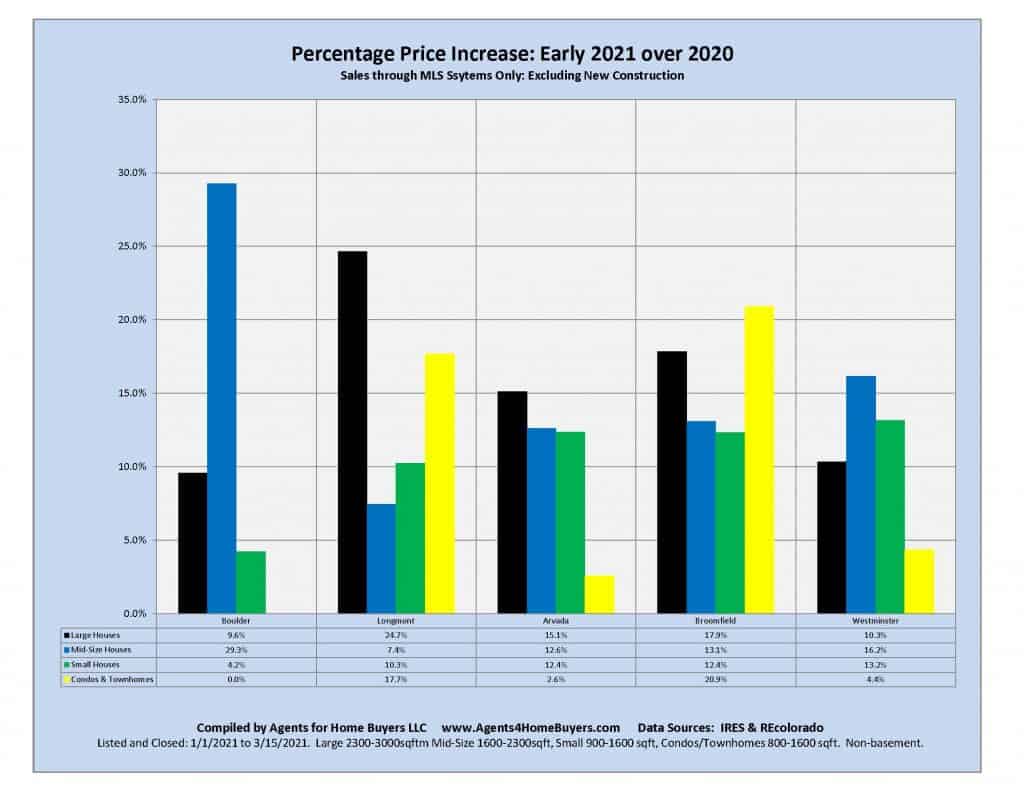

Historically, price increases for housing in our area have averaged about 5% year on year. Since 2013, these increases have averaged 8% to 9% annually for detached houses and 9.5% for condos & townhomes. Each year, most of the annual increase has occurred in the first 6 months of the year, with prices plateauing during the second half of the year. For detached homes, the highest annual increases from 2013 to 2020 were in 2014 and 2015, with average increases running in the 12% to 14% range.

Since our data on closed sales in 2021 are limited, we have restricted our pricing analysis to the five larger communities we routinely cover in our stats; Boulder, Longmont, Arvada, Broomfield and Westminster. As illustrated in the chart below, except for Boulder, the prices for all detached houses have increased between 10% and 15%. Indeed, averaged across the 3 house sizes we break out in these data, all 5 communities experienced price increases of between 13% and 14.4% in the first 10 weeks of 2021, ranging from 13.2% and 13.4% in Westminster and Arvada, to 14.1% for Longmont and 14.4% for Broomfield and Boulder. We've had a couple of years since 2013 where we've seen increases that slightly exceeded these, but those were cumulative increases over the entire year, not increases for the first 10 weeks. We've never seen anything like this before and it's difficult to believe that we won't see median prices for detached houses up by ~20% by June 2021. That's "off the charts" for our market.

The data on price increases for condos and townhomes is less consistent. In Boulder, Arvada and Westminster, condo prices have either been flat or have increased about 4%. In contrast, prices in Longmont and Broomfield are up about 20%. It's hard to predict what will happen with these prices as the year plays out.

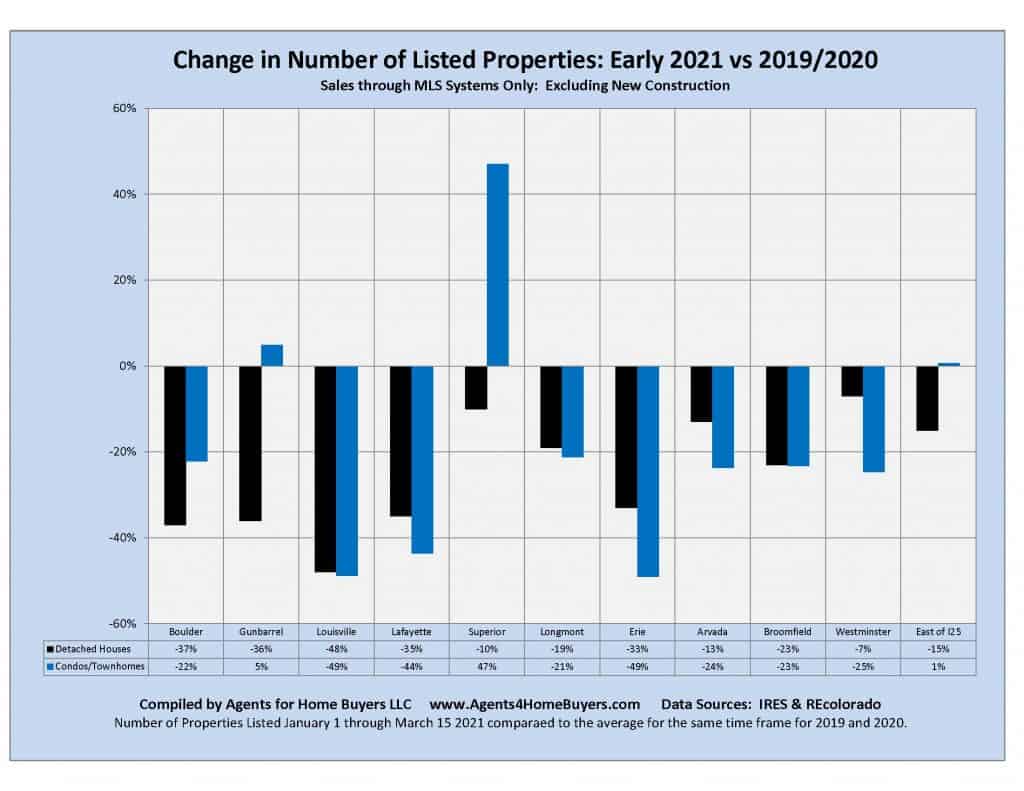

Listings and Inventory

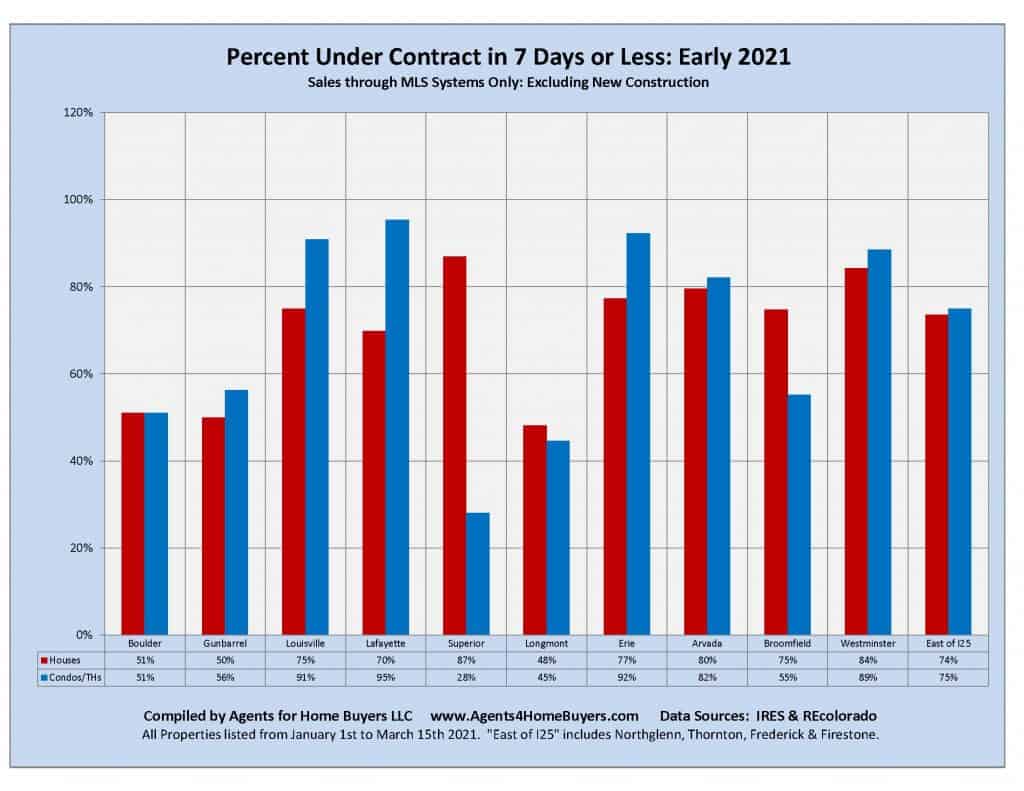

Houses Selling Faster than Ever

| In concrete terms, here is what this means for home buyers. In Gunbarrel, as of 2pm on April 1st, 2021, there were 3 detached houses available for sale. For Louisville and Lafayette, there were 7 available in each. In the 7 Boulder County communities we cover, there was a total of 78 house for sale. In Arvada, Broomfield, and Westminster, there were 71. That's not all the houses meeting the search criteria for a particular buyer, that's all the houses ranging in price from 400K to a couple million...and most of these are still available only because they've either been listed in the past few days or because no buyer in his or her right mind would buy them. If the active buyers working with our office were the only buyers in the market, we could put 1/10th of the properties in either of these areas under contract tomorrow. Most moderate to large real estate offices are probably working with enough buyers that they could put all of the houses currently on the market in either area under contract. The imbalance between supply and demand is daunting. |

Asking Price Vs. Selling Price

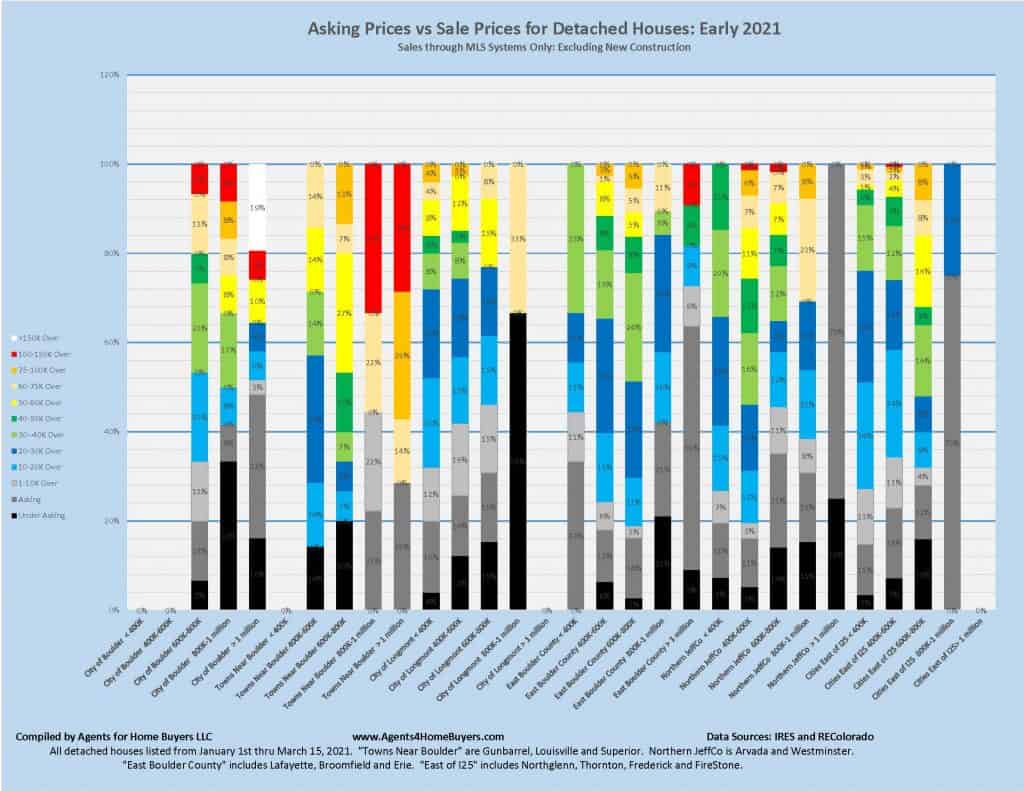

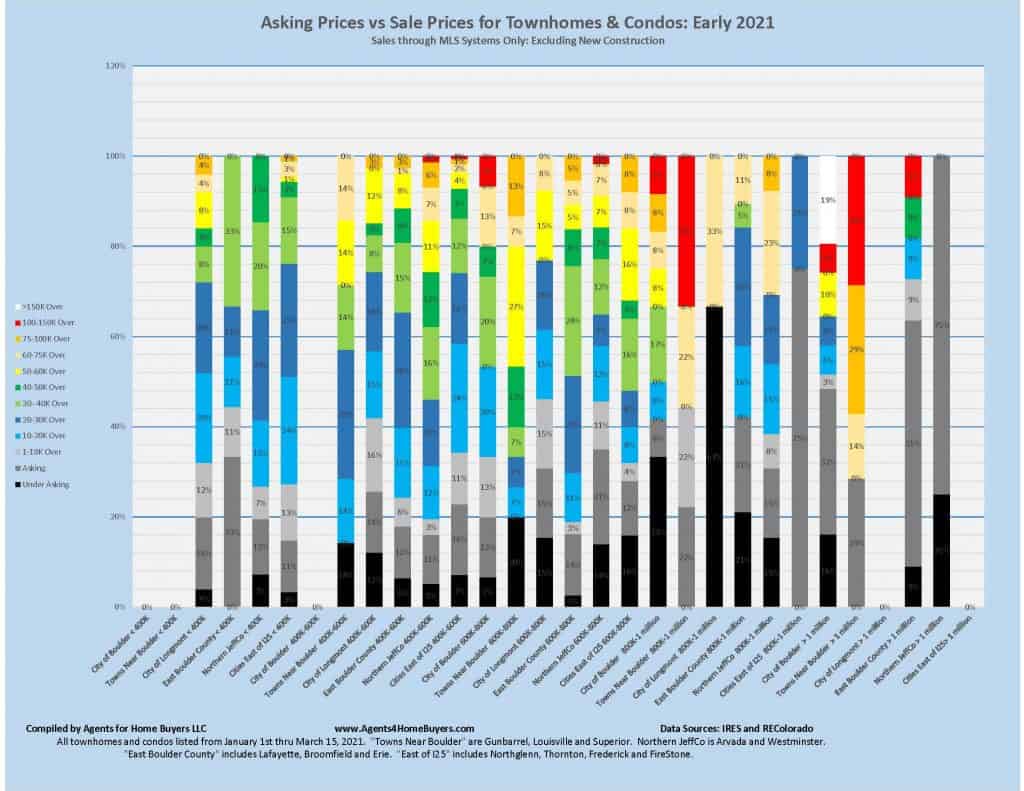

This imbalance of supply and demand underlies the most disturbing feature of this new real estate market, that is, the dramatic increase we've seen in the differential between the seller's asking price and the "winning bid" of the buyer that closes on the sale. The charts below summarize the data for all the sales in our area for homes that were listed since January 1st, 2021 and that closed by March 15th. Even a cursory scan of these data makes it clear why median home prices in the area have jumped by 14% over the past 10 weeks.

The data on detached houses is the most troubling to buyers in this market. There's a lot of data summarized in this chart, so it takes a bit of work to digest, but for anyone who wants to understand what's happening in the market we think it's worth the effort. In the challenging market of 2013 to 2020, we routinely advised clients that they would have to offer $10K to $15K over asking to have a realistic shot at winning the bidding war...and winning offers of $20K to $30K weren't rare. But in 2021, 48% of all the winning offers reflected in this data were MORE than $20K over asking price. For what we've called "Towns Near Boulder" in the chart, which includes Gunbarrel, Louisville and Superior, 68% of all closed sales showed a closing price that was more than $20K over the asking price, while more than half the sales closed at more than $50K over the asking price. In Northern Jefferson County, which includes Arvada and Westminster, 54% of houses sold for more than $20K over asking, and 24% sold for $50K or more over asking. East of I25, and area running from Northglenn and Thornton to Frederick and Firestone, 50% of sales closed at more than $20K over asking, with 15% selling at $50K or more over asking. In Boulder, "only" 30% went for more than $50K over asking, but 1 in 5 buyers making offers on homes over $1,000,000 (the median price in Boulder) closed at more than $150K over asking. There is no safe haven in the area for the buyer who wants a detached, single family house.